Why Your Business Needs Accounting/Finance Software

📈 1. Real-Time Financial Visibility

Having up-to-date information about your company’s financial status is essential for making informed decisions. With accounting software, you get real-time insights into key metrics like cash flow, revenue, expenses, and profit margins. This enables better financial planning and more accurate decision-making.

🔄 2. Automation of Repetitive Tasks

Accounting software automates repetitive tasks such as:

- Invoicing and billing

- Expense tracking

- Tax calculations

- Payroll processing

Automation not only saves time but also reduces the risk of errors and improves overall accuracy in financial operations.

🔒 3. Enhanced Security and Data Protection

Traditional accounting methods are often vulnerable to data loss or security breaches. Cloud-based accounting software offers data encryption, secure access controls, and backup systems, ensuring that your sensitive financial data is protected at all times.

💼 4. Improved Compliance and Reporting

Staying compliant with tax laws and industry regulations is vital for any business. Accounting software simplifies tax calculations, audit trails, and regulatory reporting, ensuring that your business remains compliant with minimal effort. It also generates detailed reports for internal or external audits.

🧮 5. Financial Accuracy and Error Reduction

Manual accounting is prone to human error, which can lead to costly mistakes. Accounting software helps ensure precision in calculations, reducing the risk of errors and discrepancies in your financial data. This also ensures that you’re always ready for an audit without any last-minute hassles.

Key Features of Accounting/Finance Software

1. General Ledger

The general ledger is the backbone of your financial system. It stores all transaction details and categorizes them into appropriate accounts. This system is essential for financial reporting and analysis.

2. Accounts Payable & Receivable

- Track what you owe and what’s owed to you with easy-to-use accounts payable and receivable features.

- Automate reminders for outstanding invoices to ensure you never miss payments or overdue bills.

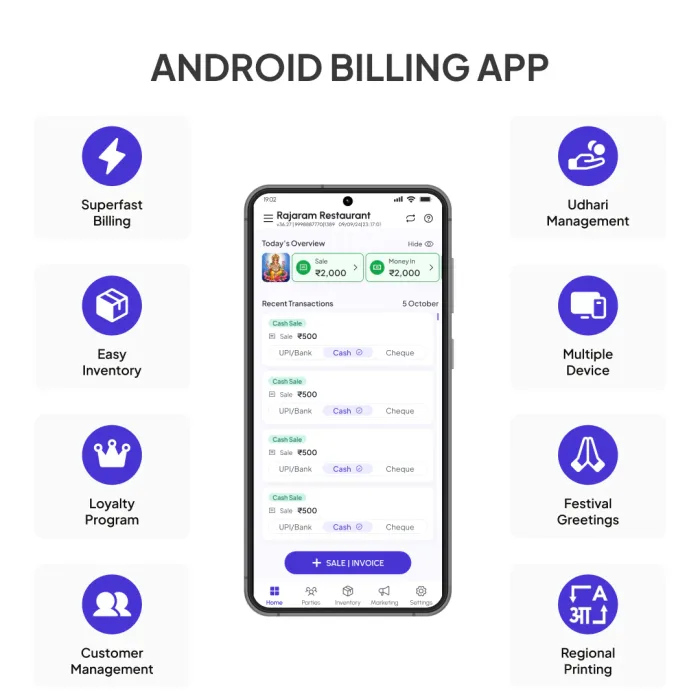

3. Invoice and Billing Management

- Generate invoices quickly and send them to customers directly from the software.

- Automatically track payments and overdue amounts, reducing delays in payment collection.

4. Cash Flow Management

- Monitor income and expenses in real time to stay on top of your business's financial health.

- Forecast future cash flow to anticipate periods of surplus or shortfall.

5. Expense Tracking

- Track business expenses easily by categorizing purchases and assigning them to specific projects, departments, or teams.

- Attach receipts to expenses for better documentation and transparency.

6. Payroll Management

- Automatically calculate salaries, tax deductions, and generate payslips for employees.

- Ensure compliance with tax laws and reduce manual payroll errors.

7. Financial Reporting

- Generate a range of financial reports, such as profit & loss statements, balance sheets, cash flow statements, and more.

- Customizable reports allow you to track key metrics specific to your business needs.

8. Tax Management

- Automate tax calculations and ensure accurate filing at the end of each financial period.

- Stay updated with changing tax regulations to ensure your business remains compliant.

9. Budgeting & Forecasting

- Set financial goals and budgets for the business, departments, or specific projects.

- Track performance against these budgets and generate forecasts based on historical data.

Benefits of Using Accounting/Finance Software

Time-Saving Automation

By automating routine financial tasks such as data entry, invoicing, and tax calculations, accounting software saves your team valuable time, allowing them to focus on more strategic tasks like financial analysis and forecasting.

Improved Accuracy

Automated calculations and error-free data entry reduce the chances of human errors, ensuring your financial reports and transactions are always accurate.

Better Cash Flow Management

With features like cash flow tracking, automated invoicing, and overdue payment reminders, you can stay on top of your business's financial health and avoid cash flow issues.

Seamless Collaboration

Accounting software makes it easier for teams to collaborate and access financial data in real time. Multiple users can view, edit, and update financial records simultaneously, leading to smoother operations and faster decision-making.

Scalable and Flexible

As your business grows, your accounting software can scale with it. Whether you’re adding new users, managing additional products, or expanding to new locations, your software can handle increased complexity.