In this rapidly evolving monetary world, the microfinance software program is the spine of financial inclusion that enables MFIs, cooperative societies, and NBFCs to control strategies and reach out to the unprivileged or unreachable human beings. In today`s virtual transformation era, monetary carrier vendors more and more rely upon microfinance software in automating lending workflows and enhancing data accuracy for higher patron experiences.

At Webloxic Technology, we recognize the demanding situations confronted via way of means of microfinance establishments: from dealing with mortgage programs to monitoring payments and ensuring regulatory compliance. That is why our microfinance software program answers were designed to simplify such complicated monetary operations and unfastened the institutions to pay attention extra on empowering human beings in preference to doing guide paperwork.

What is Microfinance Software?

The microfinance software program is a specialized generation that enables microfinance establishments to automate and control all their financial services. It helps mortgage origination, disbursement, payments, hobby calculations, patron control, and reporting on a unmarried centralized platform.

It digitizes and centralizes operations, permitting MFIs to intensify transparency, reduce mistakes, and maintain correct records. Be it institution loans, character microloans, or financial savings bills that a company is offering, the microfinance software program guarantees that each procedure is efficient, scalable, and absolutely compliant with financial rules.

Key Features of an Advanced Microfinance Software

Webloxic Technology designed this microfinance software program, keeping cutting-edge monetary establishments in mind. Here are several important functions that make it a game-changer:

1. Automate Loan Management

Automation reduces guide intervention, from the mortgage software to approval, disbursement, and collection. The machine can calculate hobbies, schedule, or even ship out price reminders routinely for smoother mortgage control and decreased instances of default.

2. Client and Member Management

With a strong microfinance software program, you are capable of controlling whole profiles of clients, mortgage histories, KYC records, and insights into financial behavior. The statistics-knowledgeable know-how allows those establishments to make knowledgeable lending selections.

3. Accounting and Financial Reporting

With included accounting, bookkeeping is a good deal easier, and financial reporting is brought accurately. Real-time dashboards allow nearly immediate visibility into coin flow, profits, and awesome loans, making control selections quicker and more effective.

4. Group and Individual Loan Handling

Microfinance establishments regularly want to deal with each institution-primarily based totally and character lending models. The software program handles each with ease, permitting flexible structuring of loans and monitoring of payments for exclusive classes of borrowers.

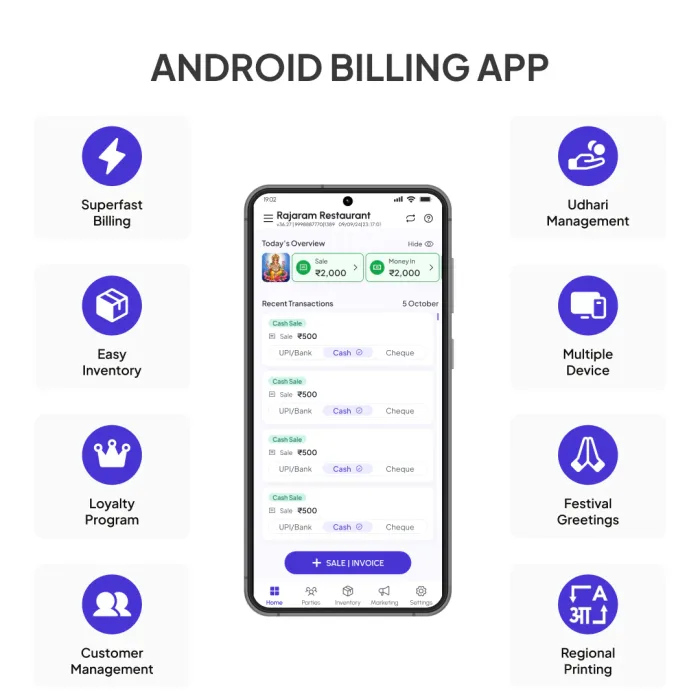

5. Mobile and Cloud Access

Cloud-primarily based totally microfinance software program lets in establishments to function remotely. Field officials can report transactions or replace patron statistics at the pass in real time from cell devices, and records are timed and handy at any time.

6. Regulatory Compliance

Regional and countrywide rules surround microfinance operations on each side. The machine routinely generates compliance reviews and audit trails, lowering the danger of mistakes or different consequences because of non-compliance.

Benefits of Using Microfinance Software

Other than automation, the advantages of microfinance software program implementation are monstrous in converting the way establishments work, enhancing performance, and growing accept as true with amongst customers. How?

Improved Efficiency: Loan and mortgage compensation approaches take a great deal much less time and resources; hence, establishments can serve more customers with ease.

Reduced Risk: Accurate records control reduces human blunders and fraudulent activities.

Improved Customer Experience: Fast approval, on the spotaneously notifications, and transparency in monitoring enhance the borrowers` experience.

Scalability: The device will grow together along with your organization because it expands to cater to greater customers, loans, and monetary products.

Analytics Dashboards: Data-driven insights throughout fashion identification, threat evaluation, and greater knowledgeable commercial enterprise decision-making.

How Webloxic Technology's Microfinance Software Makes a Difference

Our microfinance software program at Webloxic Technology is constructed with a deep understanding of the wishes of the financial sector. We couple an effective era with a user-friendly design, making elaborate monetary obligations easy and instinctive.

Our platform has been advanced for seamless mortgage control, borrower monitoring, computerized calculations, and real-time reporting, in which superior encryption protects sensitive financial records. Be it a startup MFI or a large-scale NBFC, our software program adapts to the dimensions and intentions of your organization.

Webloxic's microfinance software program is designed to improve operational performance and enhance consumer delight through its customizable modules, integrations, and responsive design.

Future of Microfinance: Driven via way of means of Digital Innovation

The destiny of microfinance for this reason lies in sensible automation, record analytics, and mobile-first technologies. By embracing those virtual tools, monetary establishments can increase their offerings to far-off communities, offer custom-designed offerings, and ensure financial sustainability.

The microfinance software program will then play an extensive role in this change through the spontaneous decision-making, steady transactions, and AI-driven credit score scoring models. Webloxic Technology maintains to innovate in this area and is assisting establishments to free up the actual ability of virtual microfinance.

Conclusion

While monetary inclusion is deeply entwined with the virtual transformation technique, the microfinance software program is an extensive best friend for microfinance establishments in such an age. It bridges gaps among eras and network finance, because it has made lending faster, smarter, and greater transparent. At Webloxic Technology, we consider the energy of allowing monetary increase through innovation. Our microfinance software program allows businesses to offer higher monetary offerings, improve performance in operations, and create an enduring social impact. If your organization desires to improve its lending technique for the sake of attracting more customers strongly, funding in a microfinance software program holds the important thing to success.